net investment income tax 2021 proposal

Net Investment Income Tax NIIT on S Corp Profits If MAGI exceeds 500000 for a joint filer or 400000 for a single filer S Corporation profits will be subject to the 38. New Income Tax Slabs Rates for FY 2021-22 AY 2022-23.

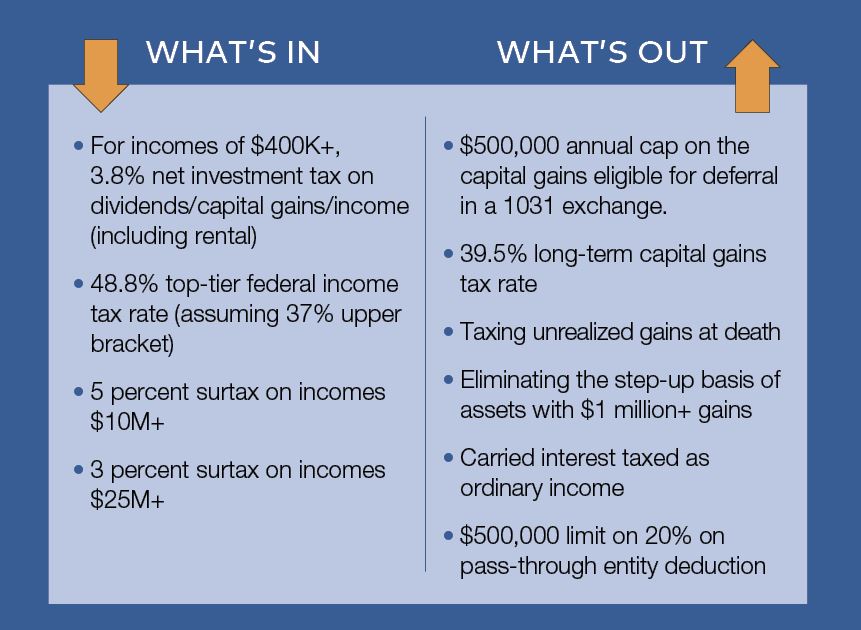

What Carried Interest Is And How It Benefits High Income Taxpayers

House Ways and Means Committee tax proposal September 13 2021.

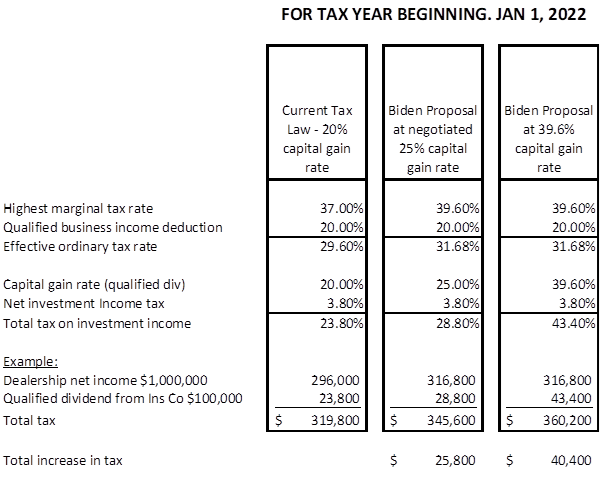

. For 2021 the government will raise 275 billion in revenue generated from net investment income tax alone according an analysis by the Congressional Research Service. The proposal would increase the capital gains tax rate for individuals earning 400000 or more to 25 from 20. B the excess if any of.

High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. At first blush the proposal. Thai Income Tax Bands 2021.

By Richard Yam JD. These additional taxes would apply for taxable years beginning after December 31 2021. Big Changes to Come.

This change would be effective as of September 13. 2021 the Proposal extends the holding period of a carried interest from three years to five. April 2021 Learn how and when to remove this.

38398 for Philadelphia residents. There are seven federal income tax rates in 2023. An additional 3 tax will be imposed on a taxpayers modified adjusted.

In the case of an estate or trust the NIIT is 38 percent on the lesser of. An increase in the top individual tax rate from 37 to 396 for tax years ending after Dec. Expands the 38 net investment income tax for taxpayers earning over 500000 married.

A special transition rule provides that the proposed maximum tax rate of 25 percent would only apply to qualified dividends and long-term capital gains realized after. The adjusted gross income. This proposal would be effective for tax years beginning after Dec.

A the undistributed net investment income or. Fortunately there are some steps you may be. July 21 2021.

Top marginal rate is 37. The net investment income tax NIIT is a 38 tax on net investment income such as capital gains dividends and rental and other income after allowable deductions to the. Increase in the maximum long-term capital gains rate The maximum capital gains rate would increase to.

This may also be due to the net investment income tax further detailed below. The increase in the base capital gains tax rate from 20 to 25 is proposed to be effective for most gains recognized after September 13 2021 while the 3 surtax and. The surcharge is either 5 or 8 e the initial 5 plus an additional 3 on the.

38 surtax on net investment income over applicable. Ensure that all pass-through business income of high-income taxpayers is subject to either the net investment income tax NIIT or SECA tax. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

November 3 2021.

What Is Net Investment Income Tax Youtube

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Export Tax Incentives The Effect Of Potentially Rising Tax Rates Journal Of Accountancy

The Biden Administration Proposes Far Reaching Tax Overhaul Brown Edwards

2021 Tax Outlook Proposals Planning Inside Indiana Business

Tax Policy Largely Stays The Course For Cre Execs Commercial Property Executive

The Minimum Book Tax Is Not A Second Best Reform

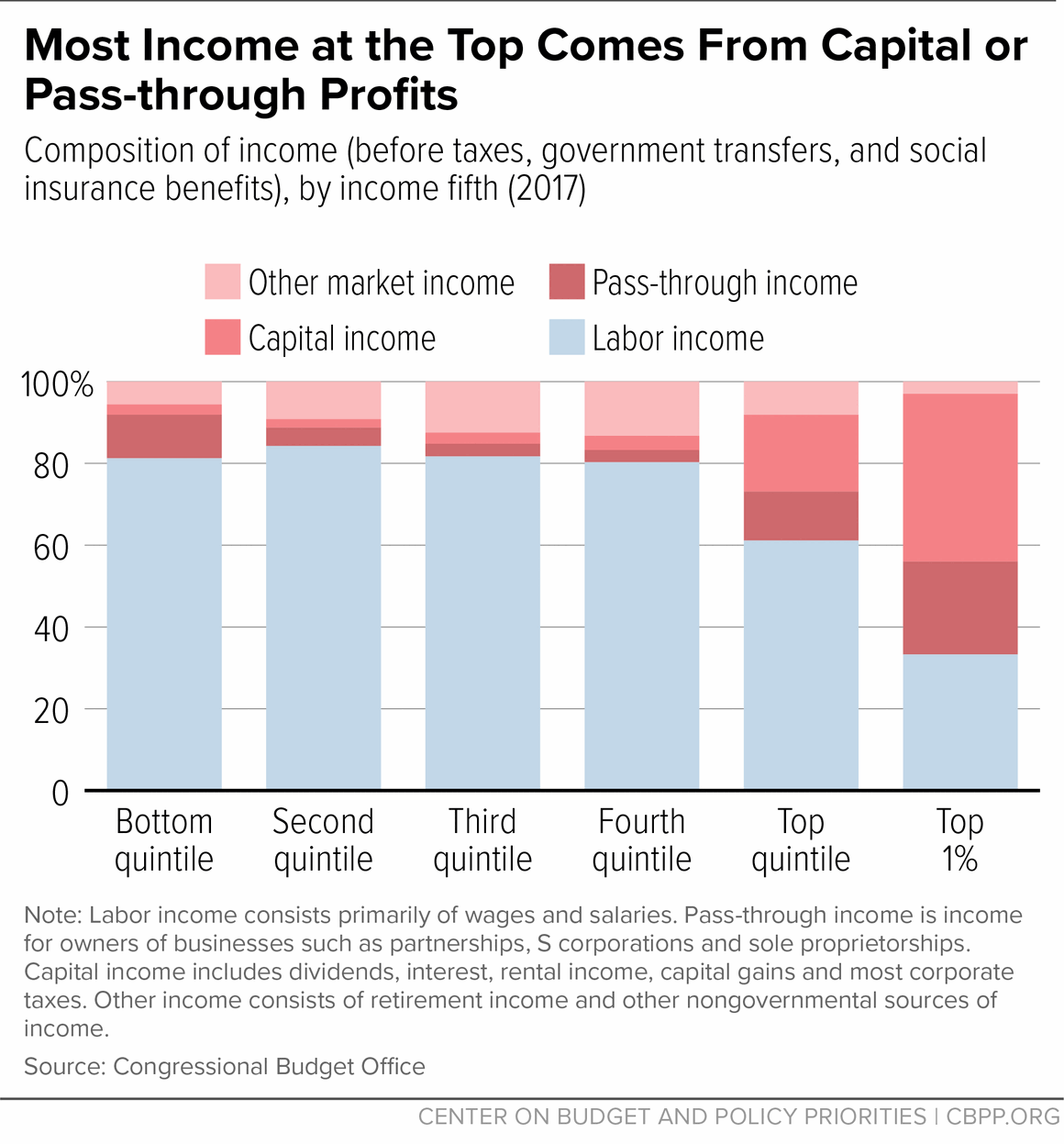

Asking Wealthiest Households To Pay Fairer Amount In Tax Would Help Fund A More Equitable Recovery Center On Budget And Policy Priorities

Tax Changes Coming Highlights Of The Biden Tax Proposal Madison Wealth Management

Capital Gains Tax In The United States Wikipedia

Gov Justice Proposes 10 Personal Income Tax Cut

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

Biden Administration Tax Proposals Implications For Commercial Real Estate United States Cushman Wakefield

Tax Increases For Wealthy To Pay For Social Programs Under Biden S Proposed American Families Plan Chugh

How Are Capital Gains Taxed Tax Policy Center

Tax Changes For 2022 Kiplinger

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

Provisions In Biden S Tax Proposal That May Cost You Money Ketel Thorstenson Llp